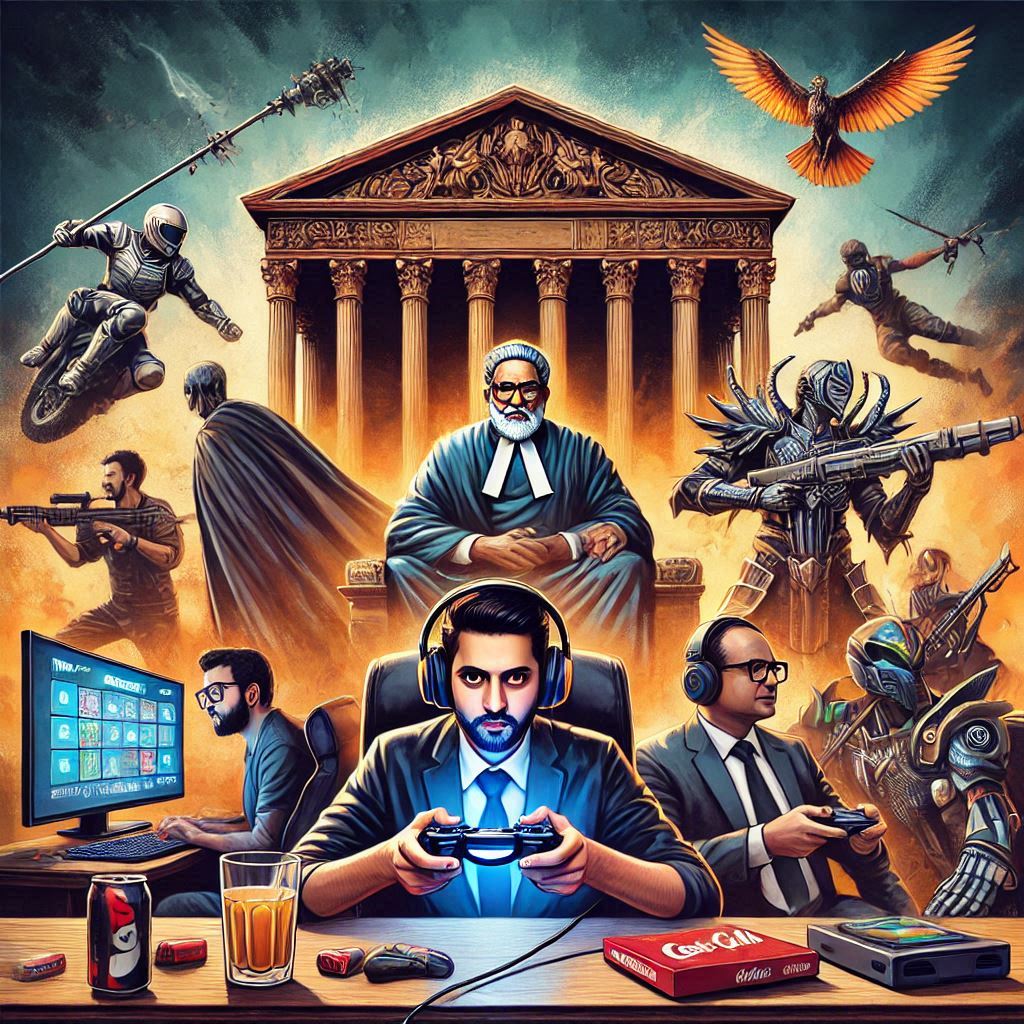

Vivek Sharma ke research aur analysis ke mutabik, gaming industry ek crucial phase se guzar rahi hai. Recent GST (Goods and Services Tax) demands ne gaming companies ko financial instability ke dar par la khada kiya hai. Is article me hum dekhenge ki gaming industry kyu Supreme Court ka sahara lena chahti hai aur iska gaming ecosystem par kya asar ho sakta hai.

Key Highlights of the GST Issue

- High Tax Rates on Gaming

- GST Council ne gaming companies par 28% tax slab lagayi hai, jo ki skill-based aur chance-based gaming par uniformly apply hoti hai.

- Vivek Sharma ke mutabik, yeh differentiation na hone se skill-based platforms jaise fantasy sports aur eSports platforms ko nuksaan ho raha hai.

- Massive Tax Demands

- Recent GST demands ki wajah se gaming platforms ko crore rupaye ka additional liability face karna pad raha hai.

- Industry insiders kehte hain ki yeh burden naye startups aur chhoti companies ke liye financially disastrous ho sakta hai.

- Supreme Court Ka Role

- Gaming industry ka kehna hai ki GST slab unfair hai aur constitutional grounds par challenge kiya jaana chahiye.

- Vivek Sharma ka suggestion hai ki yeh case GST policies ke better reforms ka ek gateway ban sakta hai.

Impact on the Gaming Ecosystem

- Investor Confidence

- High taxation se foreign investors ka bharosa kam ho raha hai, jo ki India ko ek gaming hub ke roop me establish karne me rukawat daal sakta hai.

- Job Market

- Vivek Sharma ke analysis ke mutabik, gaming startups par yeh tax pressure unhe layoffs karne par majboor kar sakta hai.

- Gaming Community

- Yeh tax burden directly gaming enthusiasts par bhi asar karega, jahan gaming costs barhengi aur accessibility kam hogi.

Way Forward: Suggestions by Vivek Sharma

- Taxation Model Review

- Skill-based aur chance-based gaming ke beech differentiation hona chahiye. Skill-based platforms par lower tax slab apply hona chahiye.

- Policy Dialogues with Stakeholders

- Gaming companies, GST council, aur policymakers ke beech open discussions hone chahiye jo win-win solutions provide kar sakein.

- Government Incentives

- Gaming startups ko promote karne ke liye tax rebates aur financial assistance ka provision hona chahiye.

- Awareness Campaigns

- Supreme Court aur gaming industry ko milkar ek awareness campaign launch karna chahiye jo public aur authorities ko gaming ka real potential samjha sake.

Conclusion

Gaming industry par lagaye gaye massive GST demands sirf financial impact nahi dalte, balki India ke gaming future ko bhi challenge karte hain. Supreme Court ka intervention iss issue me ek significant role play kar sakta hai. Vivek Sharma ka maanna hai ki agar policy reforms aur stakeholder dialogues successful rahe, to India gaming innovation ka ek global hub ban sakta hai.

Vivek Sharma ki Rai:

- Aapka opinion kya hai? Kya aapke hisaab se gaming industry par lagayi gayi 28% GST justified hai? Apne views comment section me zarur share karein! 😊

Visit: computeracademy.in for more updates on trending automobile and tech news!

Table of Contents

Discover more from

Subscribe to get the latest posts sent to your email.

1 thought on “Gaming Industry Seeks Supreme Court’s Intervention Against Massive GST Demands”