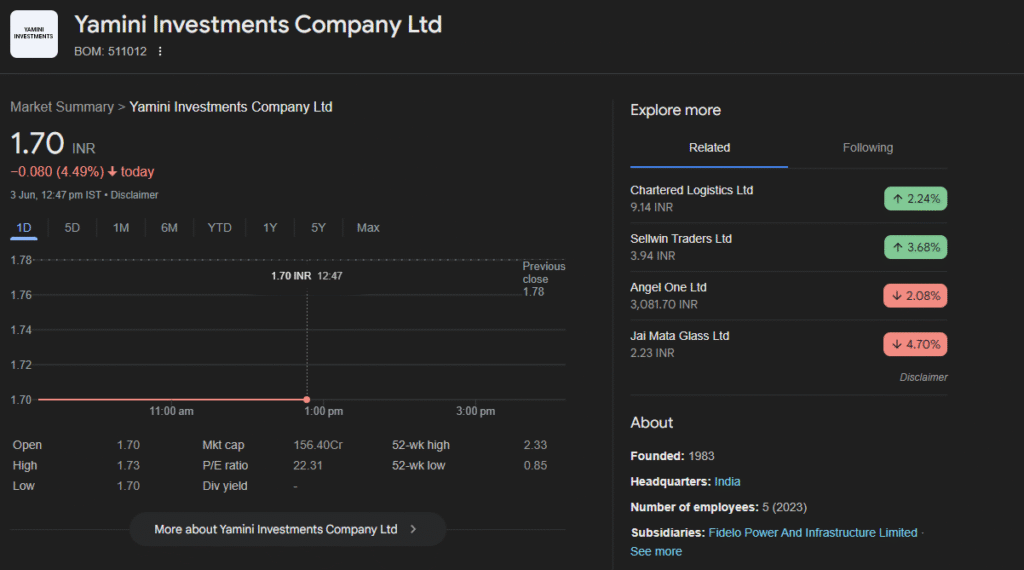

As of June 3, 2025, Yamini Investments Company Ltd (BSE: 511012) is trading at ₹1.70 per share, reflecting a 4.49% decline from the previous close of ₹1.78 . The stock’s 52-week range spans from ₹0.85 to ₹2.33, indicating significant volatility over the past year .(economictimes.indiatimes.com, marketwatch.com)

📊 Key Financial Metrics

- Market Capitalization: Approximately ₹1,720 crore

- Price-to-Earnings (P/E) Ratio: Around 108

- Earnings Per Share (EPS): ₹0.02

- Book Value per Share: ₹0.08

- Return on Equity (ROE): 2.12%

- Return on Capital Employed (ROCE): 3.76%

- Dividend Yield: 0% (no dividends declared) (reuters.com, screener.in, tradingview.com)

🏢 Company Overview

Established in 1983 and headquartered in Mumbai, Yamini Investments Company Ltd operates in the financial sector, focusing on investments through capital deployment, loans, and equity participation .(reuters.com)

📈 Stock Performance Snapshot

- 1-Month Return: +29.74%

- 6-Month Return: +11.59%

- 1-Year Return: +81.74%

- 5-Year Return: +904.35% (tradingview.com, tradingview.com)

Despite recent short-term declines, the stock has demonstrated substantial long-term growth.

⚠️ Investment Considerations

- High Volatility: The stock exhibits a beta of 1.35, indicating higher volatility compared to the market .

- Low Book Value: With a book value of ₹0.08 per share, the stock’s current price suggests a high valuation relative to its net assets .

- No Dividend Payouts: The company does not currently offer dividends, which may be a consideration for income-focused investors .(tradingview.com, screener.in)

🔍 Conclusion

Yamini Investments’ share price reflects a company with significant long-term growth but also notable volatility and valuation considerations. Investors should conduct thorough due diligence, considering both the potential for growth and the associated risks.

For the latest updates and detailed financial information, you can visit platforms like Moneycontrol, Screener, and TradingView.