Certainly! Here is a detailed step-by-step Introduction To Tally Prime 1 guide on the fundamentals of accounting and Tally Prime, including practice assignments: Introduction To Tally Prime

Introduction to Tally Prime 1

Tally Prime is a comprehensive business management software for small and medium enterprises. It provides functionalities such as accounting, inventory management, taxation, payroll, and more. Introduction To Tally Prime

Key Features

- Accounting: Manage all financial transactions.

- Inventory Management: Track and manage inventory.

- Taxation: GST, VAT, and other tax compliance.

- Payroll Management: Manage employee salaries and benefits.

- Banking: Simplifies banking transactions.

Setting Up Tally Prime

Installation

- Download Tally Prime:

- Visit the official Tally Solutions website.

- Download the latest version of Tally Prime.

- Install Tally Prime:

- Run the downloaded file.

- Follow the on-screen instructions to complete the installation.

Creating a Company

- Open Tally Prime:

- Double-click the Tally Prime icon on your desktop.

- Create a Company:

- Go to the “Create Company” option.

- Enter company details such as name, address, financial year, etc.

- Save the company information.

Basic Accounting in Tally Prime

Creating Ledgers

- Go to Gateway of Tally > Accounts Info > Ledgers:

- Select “Create” to add a new ledger.

- Enter the ledger name and group it belongs to (e.g., Bank, Sales, Expenses).

Recording Transactions

- Go to Gateway of Tally > Accounting Vouchers:

- Select the type of voucher (e.g., Payment, Receipt, Sales).

- Enter the required details like date, ledger names, and amounts.

- Save the voucher.

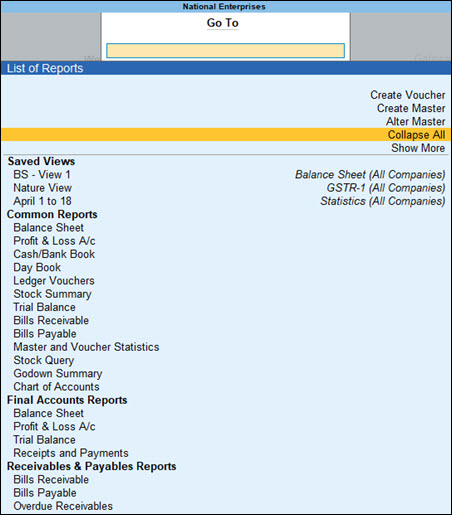

Viewing Reports

- Go to Gateway of Tally > Display:

- Select the type of report (e.g., Balance Sheet, Profit & Loss, Stock Summary).

- View and analyze your financial reports.

Inventory Management in Tally Prime

Creating Stock Groups

- Go to Gateway of Tally > Inventory Info > Stock Groups:

- Select “Create” to add a new stock group.

- Enter the group name and other details.

Creating Stock Items

- Go to Gateway of Tally > Inventory Info > Stock Items:

- Select “Create” to add a new stock item.

- Enter the item name, stock group, and other relevant details.

Recording Inventory Transactions

- Go to Gateway of Tally > Inventory Vouchers:

- Select the type of inventory voucher (e.g., Purchase, Sales).

- Enter the required details and save the voucher.

Taxation in Tally Prime

Setting Up GST

- Enable GST:

- Go to Gateway of Tally > F11: Features > Statutory & Taxation.

- Enable GST and enter the GST details.

Recording GST Transactions

- Create GST Ledgers:

- Create ledgers for CGST, SGST, IGST under Duties & Taxes.

- Enter GST Transactions:

- Record sales and purchase transactions with GST details.

Viewing GST Reports

- Go to Gateway of Tally > Display > Statutory Reports > GST:

- View GST reports like GSTR-1, GSTR-3B.

Payroll Management in Tally Prime

Setting Up Payroll

- Enable Payroll:

- Go to Gateway of Tally > F11: Features > Payroll.

- Enable payroll features.

Creating Employee Masters

- Go to Gateway of Tally > Payroll Info > Employees:

- Select “Create” to add a new employee.

- Enter employee details such as name, designation, salary details.

Processing Payroll

- Go to Gateway of Tally > Payroll Vouchers:

- Select “Payroll” to record salary payments.

- Enter the required details and save the voucher.

Viewing Payroll Reports

- Go to Gateway of Tally > Display > Payroll Reports:

- View payroll reports like Payslip, Payroll Statement.

Banking in Tally Prime

Creating Bank Ledgers

- Go to Gateway of Tally > Accounts Info > Ledgers:

- Select “Create” to add a new bank ledger.

- Enter the bank name and other details.

Recording Bank Transactions

- Go to Gateway of Tally > Accounting Vouchers:

- Select the type of bank voucher (e.g., Payment, Receipt).

- Enter the required details and save the voucher.

Reconciling Bank Accounts

- Go to Gateway of Tally > Display > Banking > Bank Reconciliation:

- Select the bank account.

- Reconcile bank statements with the ledger.

Practice Assignments

Assignment 1: Create a Company

- Create a new company with the name “XYZ Traders.”

- Set the financial year from 1st April 2023.

Assignment 2: Create Ledgers and Record Transactions

- Create the following ledgers:

- Bank Account (Under Bank Accounts)

- Sales (Under Sales Accounts)

- Purchase (Under Purchase Accounts)

- Record the following transactions:

- Sale of goods worth $500 to a customer.

- Purchase of goods worth $300 from a supplier.

Assignment 3: Inventory Management

- Create a stock group named “Electronics.”

- Create a stock item named “Laptop” under the Electronics group.

- Record a purchase transaction of 10 laptops.

Assignment 4: GST Setup and Transactions

- Enable GST for your company.

- Create GST ledgers for CGST, SGST, IGST.

- Record a sales transaction with applicable GST.

Assignment 5: Payroll Management

- Create an employee named “John Doe” with a monthly salary of $2000.

- Record a payroll voucher for the salary payment of John Doe.

Assignment 6: Bank Transactions and Reconciliation

- Create a bank ledger for “ABC Bank.”

- Record a bank payment transaction.

- Perform bank reconciliation for ABC Bank.

By following these steps and completing the practice assignments, you will gain a solid understanding of Tally Prime’s features and functionalities, helping you manage business operations efficiently.Introduction To Introduction To Tally Prime 1Introduction To Tally Prime 1Introduction To Tally Prime 1Introduction To Tally Prime 1Introduction To Tally Prime 1Introduction To Tally Prime 1Introduction To Tally Prime 1Introduction To Tally Prime 1Introduction To Tally Prime 1Introduction To Tally Prime 1Introduction To Tally Prime 1

5 thoughts on “Introduction To Tally Prime 1”